The UAE’s Fast-Moving Consumer Goods (FMCG) industry is a dynamic and ever-evolving landscape. As we approach 2025, several key trends are poised to significantly impact the way businesses operate and manage their finances. These trends necessitate a shift in the skillsets and competencies required by accounting and finance professionals within the FMCG sector. This article explores the most critical accounting and finance trends in the UAE’s FMCG industry for 2025, highlighting the need for competency building and the value of strategic training programs. We will delve into four key areas:

- Sustainable Business Growth: Integrating environmental, social, and governance (ESG) considerations into financial planning and decision-making.

- Adjusting Economic Realities: Adapting to potential economic fluctuations and ensuring financial resilience.

- Big Data & Analytics: Leveraging big data and advanced analytics to optimize financial performance.

- Adjusting to Blockchain and Payment Systems: Understanding and navigating the evolving landscape of blockchain technology and digital payment systems.

1. Sustainable Business Growth: The Future is Green

Sustainability is no longer a peripheral concern; it’s a core business driver. Consumers are increasingly making purchasing decisions based on a company’s environmental and social responsibility. Here’s how this trend impacts accounting and finance:

- ESG Reporting and Integration: Developing frameworks to measure and report on ESG performance metrics alongside traditional financial indicators.

- Cost-Benefit Analysis of Sustainability Initiatives: Evaluating the financial implications of sustainable practices, considering both short-term costs and long-term benefits.

- Investment in Sustainable Technologies: Assessing the financial viability of investments in sustainable packaging, renewable energy sources, and resource-efficient production processes.

Competency Building and Training Needs:

- Understanding ESG Frameworks: Training on frameworks like Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB).

- Life Cycle Costing: Developing expertise in life cycle costing to assess the environmental and financial impact of products throughout their life cycle.

- Financial Modeling for Sustainability: Learning to incorporate sustainability factors into financial models and investment decisions.

2. Adjusting Economic Realities: Building Resilience

The global economic landscape is subject to unforeseen fluctuations. Here’s how accounting and finance professionals can prepare:

- Scenario Planning and Risk Management: Developing robust scenario planning models to assess the impact of potential economic downturns on the business.

- Cash Flow Management: Implementing strategies to optimize cash flow and ensure financial stability during economic uncertainties.

- Cost Optimization and Efficiency Measures: Identifying areas for cost reduction and streamlining operations to maintain profitability.

Competency Building and Training Needs:

- Financial Forecasting and Modeling: Advanced training in financial forecasting techniques to predict future performance under various economic conditions.

- Stress Testing: Learning to conduct stress tests to assess the financial resilience of the business under different economic scenarios.

- Cost Management Strategies: Developing expertise in cost reduction techniques and process optimization methodologies.

3. Big Data & Analytics: Transforming Financial Management

The explosion of data presents both challenges and opportunities for FMCG companies. Leveraging big data and advanced analytics is no longer a luxury; it’s a necessity for survival and growth. By harnessing the power of data, finance professionals can gain deeper insights into consumer behavior, market trends, and operational efficiency. This data-driven approach enables more accurate forecasting, improved decision-making, and optimized resource allocation.

For example, analyzing consumer purchasing patterns through loyalty programs, social media data, and point-of-sale transactions can help FMCG companies identify emerging trends, tailor product offerings, and optimize marketing campaigns. Furthermore, predictive analytics can forecast demand, optimize inventory levels, and minimize stockouts, leading to significant cost savings.

Competency Building and Training Needs:

- Data Analysis Skills: Training on data analysis tools and techniques such as SQL, Python, and R is crucial for extracting meaningful insights from large datasets.

- Business Intelligence (BI) Tools: Developing expertise in using BI tools like Tableau and Power BI to visualize and interpret financial data.

- Data-Driven Financial Modeling: Learning to incorporate data analytics into financial models for more accurate forecasting and scenario planning.

- Machine Learning Applications: Exploring the potential of machine learning algorithms for tasks such as fraud detection, customer churn prediction, and demand forecasting.

4. Adjusting to Blockchain and Payment Systems:

The rise of blockchain technology and innovative payment systems is transforming the way FMCG companies conduct business. Here’s how finance professionals need to adapt:

- Blockchain for Supply Chain Management: Understanding how blockchain technology can enhance supply chain transparency, traceability, and efficiency.

- Digital Payment Integration: Integrating with emerging digital payment platforms and ensuring seamless and secure payment processing.

- Cryptocurrency and Digital Assets: Staying informed about the potential impact of cryptocurrencies and other digital assets on the FMCG industry.

Competency Building and Training Needs:

- Blockchain Technology Fundamentals: Gaining a basic understanding of blockchain technology and its applications in the supply chain.

- Digital Payment Systems and Security: Learning about the latest payment technologies, including mobile payments, contactless payments, and e-wallets, and understanding associated security risks.

- Regulatory Compliance: Staying abreast of evolving regulations related to digital payments and data security.

The Role of Training Programs

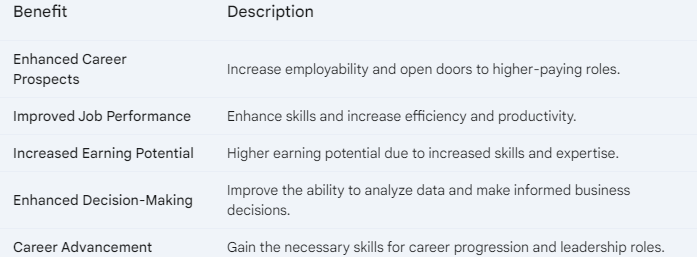

Training programs play a pivotal role in equipping finance professionals with the skills and knowledge necessary to navigate these evolving trends:

- Synergic Training: Offers a comprehensive range of training programs designed to equip professionals with the skills and knowledge needed to thrive in the dynamic FMCG sector. Our programs cover a wide range of topics, including:

- Financial Accounting and Reporting for FMCG Companies

- Cost Accounting and Management for FMCG

- Data Analytics for FMCG Finance

- Supply Chain Finance and Management

- Risk Management and Internal Controls for FMCG

- PwC: Provides a wide range of professional development programs, including specialized training for the FMCG industry.

- [Link to a reputable university business school in the UAE, e.g., Dubai Business School]: Offers a variety of academic programs and executive education courses in finance and management.

Competency Building and Training Needs:

- Data Analysis Skills: Training on data analysis tools and techniques to extract meaningful insights from financial and operational data.

- Business Intelligence (BI) Skills: Developing expertise in using BI tools to visualize and interpret financial data for informed decision-making.

- Data-Driven Financial Modeling: Learning to incorporate data analytics into financial models for more accuracy.

Conclusion:

The FMCG industry in the UAE is undergoing a period of significant transformation. By embracing these trends and investing in continuous learning and development, accounting and finance professionals can position themselves as strategic partners, driving business growth and ensuring long-term success. Synergic Training is committed to empowering individuals with the knowledge and skills they need to thrive in this dynamic environment.