RBIA

Risk Based Internal Audit

Risk Based Internal Audit

RBIA allows individuals that manage internal audit processes to consolidate risk management factors effectively and appropriately under the risk appetite set by the organization.

Training Objective

RBIA allows internal audit to provide assurance to the board that risk management processes are managed effectively and appropriately keeping in view the risk appetite set by the board.

But every Organization and management is different in terms of its attitudes to risk, organizational structures, internal processes and procedures. Experienced internal auditors need to be aware of all these and keep abreast with the changing business and Risk environment to remain relevant, impressive and effective.

This course provides a thorough overview of RBIA processes, planning stages and measurement strategies. You will gain the practical tools to set up, analyze and manage RBIA within your organization. Once implemented correctly, RBIA offers tremendous advantages to any company.

Training Content

By the end of this course you will:

- Have a sound understanding of Risk Based Internal Audit function and process and be able to differentiate it from a regular internal audit approach

- Be able to Develop and implement a Risk Based Internal Audit Plan

- Be able to add value to the Organization operation and helps management in achieving its objectives

- Be able to Advise management on the controls and risk management effectiveness

- Be able to Challenge management’s evaluation of risks, risk appetite and residual risk

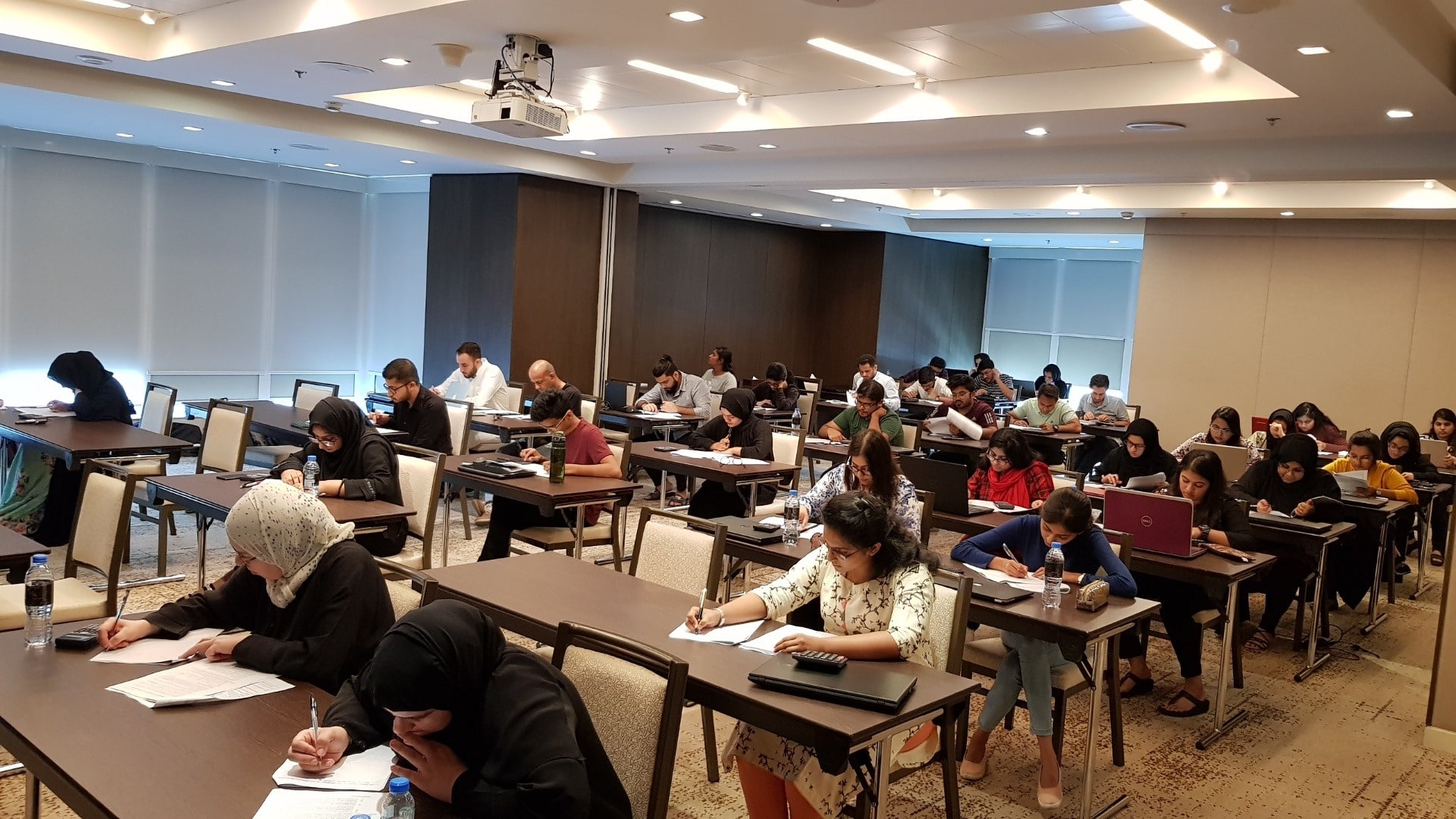

Who should attend

- Chief Audit Executives / Chief Internal Auditors

- Heads of Audit, Audit Managers and Senior Auditors

- Chief Risk Officers

- Chief Compliance Officers

- Chief Financial Officers

- Auditors (External & Internal)

- Risk management consultants

- Board members, especially risk and audit committee chairs and members

- Heads of market, credit, and operational risk

Get In Touch