Introduction:

The introduction of corporate tax in the UAE in 2023 marked a significant shift in the country’s economic landscape. While some businesses may view this as an added burden, it also presents an opportunity for strategic tax planning and optimization. This article delves into the changes brought about by the corporate tax regime, explores its impact on businesses, and emphasizes the critical role of training programs in empowering organizations to navigate this new environment and thrive.

Understanding the UAE Corporate Tax Landscape:

The UAE’s corporate tax regime applies a standard rate of 9% on the taxable profits of businesses operating in the country, with certain exemptions and incentives. Here’s a breakdown of key aspects:

- Taxable Profits: Net profits after deducting allowable expenses as per the UAE Corporate Tax Law.

- Free Zones: Certain free zones offer exemptions or reduced corporate tax rates for qualifying businesses.

- Transfer Pricing: Regulations govern transactions between related parties to ensure arm’s length pricing.

- Tax Compliance: Businesses are required to register for corporate tax, file tax returns, and pay taxes as per regulations.

Impact on Businesses:

The introduction of corporate tax necessitates adjustments for businesses in the UAE:

- Increased Costs: Companies must factor in the corporate tax expense when calculating profitability and pricing strategies.

- Enhanced Tax Planning: Effective tax planning becomes crucial to minimize tax liabilities and maximize profitability.

- Compliance Requirements: Businesses must comply with new tax filing and reporting obligations.

- Potential for Growth: The tax regime aims to attract foreign investment and stimulate economic activity, potentially leading to new business opportunities.

Strategies for Optimization:

Businesses can adopt various strategies to optimize their corporate tax position:

- Understanding Tax Exemptions: Identifying and leveraging available tax exemptions and incentives offered by the UAE government.

- Transfer Pricing Optimization: Ensuring transactions with related parties comply with arm’s length pricing regulations.

- Effective Recordkeeping: Maintaining accurate and detailed financial records to facilitate tax calculations and compliance.

- Tax Planning and Forecasting: Developing a tax plan that minimizes tax liabilities while considering future growth plans.

The Training Imperative:

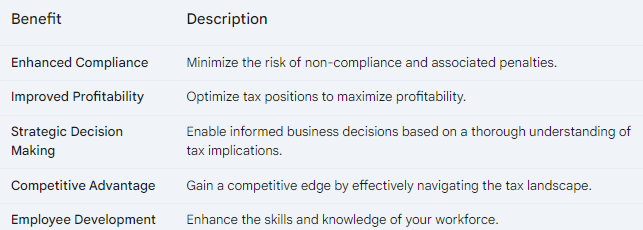

Effective corporate tax management requires a skilled workforce equipped with the necessary knowledge and expertise. Here’s where training programs play a vital role:

- Building Tax Expertise: Equipping finance professionals with a comprehensive understanding of the UAE’s corporate tax laws and regulations.

- Developing Tax Planning Skills: Training employees on strategies to minimize tax liabilities and optimize tax positions.

- Enhancing Compliance Knowledge: Ensuring employees understand tax filing procedures, deadlines, and recordkeeping requirements.

- Staying Updated: Keeping pace with evolving tax regulations and best practices through continuous training.

Synergic Training: Your Partner in Corporate Tax Success

Synergic Training recognizes the importance of equipping businesses with the knowledge and skills to navigate the new corporate tax landscape. We offer a comprehensive range of accounting and finance training programs designed specifically for the UAE market. Our programs address the critical aspects of corporate tax:

- Understanding the UAE Corporate Tax Law: Gain a thorough understanding of the key provisions, taxable income calculations, and tax filing requirements.

- Tax Planning and Optimization Strategies: Learn effective techniques to minimize tax liabilities and maximize profitability within the legal framework.

- Transfer Pricing for the UAE Market: Develop expertise in transfer pricing regulations and ensure compliance for transactions with related parties.

- Corporate Tax Recordkeeping and Reporting: Master the process of maintaining accurate financial records and filing tax returns as per UAE regulations.

Beyond Technical Expertise: A Multi-Dimensional Approach

Effective corporate tax management goes beyond technical knowledge. Synergic Training’s programs incorporate a multi-dimensional approach:

- Communication and Collaboration: Developing strong communication skills to interact effectively with tax authorities and internal stakeholders.

- Critical Thinking and Problem-Solving: Enhancing the ability to analyze complex tax scenarios and identify optimal solutions.

- Ethical Conduct and Professionalism: Upholding high ethical standards and professional conduct in tax matters.

Conclusion:

The introduction of corporate tax in the UAE presents both challenges and opportunities for businesses. By investing in training and development, organizations can equip their teams with the knowledge and skills to navigate this new landscape successfully. Synergic Training is committed to empowering businesses in the UAE with the expertise to thrive in the evolving tax environment.

For information on any of our workshops, training programs or certification programs such as the ACCA, CMA and IFRS, reach out using the following link and you will discover that we offer flexible (online or on-campus) programs and tailored programs for individuals, as well as for organizations:

https://wkf.ms/3uHnguZ

To enroll directly to our training programs, use the following link:

https://wkf.ms/3uHZRty

Learn more about how we can help you and/or your organization develop robust competencies. Visit our website or contact us today!

Tel: +971(2)6450999

Whatsaap: +971 50 5754560

Email: info@synergictraining.com

Website: www.synergictraining.com

Adress: 302, Bloom Central, Airport Street, Abu Dhabi — UAE

#TheAccociationAccountantsandFinancialProfessionalsinBusiness #ACCA #CharteredManagementAccountants #TheAccociationAccountantsandFinancialProfessionalsinBusiness #CMA #IMA #CharteredManagementAccountants #dubai #finance #accounting #abudhabi #banking #uae #accountingcareers #financecareers #financeeducation #MSExcel #datamanagement #analytics #analyticstools #analysis #TrainingCourses #Corporatetaxtraining #VATtraining