The United Arab Emirates (UAE) boasts a thriving business environment, attracting entrepreneurs and investors from across the globe. However, despite its many advantages, businesses in the UAE also face a unique set of challenges. These roadblocks can hinder growth, profitability, and long-term success. This article explores the key factors that can impede business development in the UAE and highlights how effective accounting and finance training programs empower businesses to overcome these obstacles. We will delve into a multi-dimensional approach, showcasing how training equips professionals with the skills and knowledge to navigate complex financial landscapes, optimize operations, and make informed strategic decisions.

Roadblocks to Business Growth in the UAE

Several factors can pose challenges for businesses operating in the UAE:

- Competition: The UAE market is highly competitive, with both local and international companies vying for market share.

- Regulations and Compliance: Businesses must navigate a complex regulatory environment, adhering to various federal and emirate-specific regulations.

- Access to Capital: Securing funding can be challenging for new or growing businesses, especially for those without a strong financial track record.

- Talent Acquisition and Retention: Attracting and retaining skilled professionals, particularly in specialized fields like accounting and finance, can be difficult.

- Economic Fluctuations: The global economy is subject to unforeseen fluctuations, which can impact businesses in the UAE.

- Technological Disruption: The rapid pace of technological change necessitates continuous adaptation and investment in new technologies.

The Impact of Accounting and Finance Expertise

Strong accounting and finance expertise is a cornerstone of overcoming these challenges and achieving sustainable business growth:

- Financial Planning and Analysis: Developing sound financial plans and forecasts to guide strategic decision-making and secure funding.

- Cost Management and Optimization: Implementing strategies to control costs, improve efficiency, and maximize profitability.

- Risk Management and Mitigation: Identifying, assessing, and mitigating financial, operational, and compliance risks.

- Tax Planning and Compliance: Ensuring adherence to UAE tax regulations and optimizing tax positions to minimize liabilities.

- Financial Reporting and Transparency: Providing accurate and transparent financial information to stakeholders, fostering trust and confidence.

Investing in Your People: The Power of Training

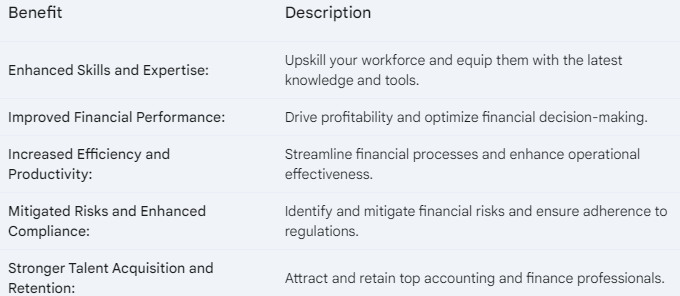

Accounting and finance training programs play a vital role in empowering businesses to overcome these challenges:

- Developing a Skilled Workforce: Equipping accounting and finance professionals with the latest knowledge, skills, and industry best practices.

- Enhancing Financial Literacy: Empowering business leaders with a strong understanding of financial concepts and their impact on business performance.

- Improving Decision-Making: Training provides the skills to analyze financial data, identify trends, and make informed strategic decisions based on sound financial principles.

- Boosting Operational Efficiency: Training can help identify and implement cost-saving measures and streamline financial processes.

- Mitigating Risk: Programs equip professionals with the knowledge to identify and mitigate financial risks, ensuring business continuity and stability.

The United Arab Emirates (UAE) is a dynamic business hub, constantly adapting to evolving global trends. In this fast-paced environment, the role of accounting and finance professionals is more critical than ever. These skilled individuals are the backbone of businesses, ensuring financial health, driving strategic decision-making, and navigating complex regulations. This article delves into the indispensable role accounting and finance expertise plays in driving business growth within the UAE, examining the evolving skillsets required by professionals in this field. We will explore the impact of technology and the importance of continuous learning and training programs, highlighting how accounting and finance professionals are transforming into strategic business partners.

The Cornerstone of Growth: Accounting and Finance Expertise

Accounting and finance professionals are not just number crunchers; they are strategic partners who contribute significantly to business success. Here’s how they drive growth:

-

Strategic Financial Planning:

- Developing and implementing comprehensive financial plans aligned with business objectives.

- Forecasting future financial performance and identifying potential risks and opportunities.

- Conducting feasibility studies and evaluating investment proposals.

-

Financial Analysis and Reporting:

- Providing accurate and insightful financial reports to stakeholders (investors, creditors, management).

- Analyzing financial data to identify trends, assess performance, and identify areas for improvement.

- Developing key performance indicators (KPIs) to track progress towards business goals.

-

Cost Management and Optimization:

- Identifying cost-saving opportunities through process improvement and efficiency enhancements.

- Implementing cost control measures to maximize profitability.

- Managing cash flow effectively to ensure liquidity and financial stability.

-

Risk Management and Mitigation:

- Identifying, assessing, and mitigating financial, operational, and reputational risks.

- Implementing strategies to ensure business continuity and stability.

The Evolving Landscape: New Skills for a New Era

The accounting and finance profession is undergoing a rapid transformation, driven by technological advancements, globalization, and increasing regulatory complexity. Key skills for success in the modern era include:

-

Data Analytics and Business Intelligence:

- Analyzing large datasets to identify trends, uncover insights, and make data-driven decisions.

- Utilizing tools like business intelligence platforms and data visualization software.

-

Technology Proficiency:

- Mastering cloud computing platforms, automation tools, and financial technology (FinTech) solutions.

- Adapting to emerging technologies like artificial intelligence (AI), machine learning, and blockchain.

-

Communication and Collaboration:

- Effectively communicating complex financial information to both technical and non-technical audiences.

- Collaborating effectively with other departments to achieve business objectives.

-

Strategic Thinking and Business Acumen:

- Understanding the broader business context and its impact on financial performance.

- Contributing to strategic planning and decision-making at the executive level.

-

Ethical Conduct and Professionalism:

- Maintaining the highest ethical standards and adhering to professional codes of conduct.

The Impact of Technology: Transforming the Role of Finance Professionals

Technology is revolutionizing the accounting and finance function in several ways:

- Automation: Automating routine tasks like data entry, reconciliations, and report generation, freeing up professionals for more strategic activities.

- Enhanced Data Analysis: Leveraging AI and machine learning to identify patterns, predict future trends, and improve decision-making.

- Cloud Computing: Enabling real-time access to financial data, facilitating collaboration, and improving operational efficiency.

- Blockchain Technology: Revolutionizing financial transactions, improving transparency, and enhancing security.

The Importance of Continuous Learning and Training

In this rapidly evolving landscape, continuous learning is crucial for accounting and finance professionals to stay ahead of the curve. Training programs offer a valuable platform to:

- Develop in-demand skills: Equipping professionals with the latest knowledge and skills in areas like data analytics, cloud computing, and cybersecurity.

- Stay abreast of regulatory changes: Ensuring compliance with the latest accounting standards, tax regulations, and industry best practices.

- Enhance professional credibility: Demonstrating a commitment to professional development and staying ahead of the curve.

Synergic Training: Your Partner in Financial Excellence

Synergic Training offers a comprehensive range of accounting and finance training programs designed to equip professionals with the skills and knowledge they need to thrive in the UAE’s dynamic business environment. Our programs cover a wide range of topics, including:

- Financial Accounting and Reporting

- Management Accounting

- Cost Accounting

- Financial Analysis and Interpretation

- Financial Modeling and Forecasting

- Taxation

- Risk Management

- Internal Audit

- Data Analytics and Business Intelligence

- Leadership and Management

Conclusion:

Accounting and finance professionals play a pivotal role in driving business growth and success in the UAE. By embracing continuous learning, developing in-demand skills, and adapting to the evolving business landscape, they can ensure their continued relevance and contribute significantly to the economic prosperity of the nation. Synergic Training is committed to empowering professionals with the knowledge and skills they need to thrive in this dynamic environment.