FMPW

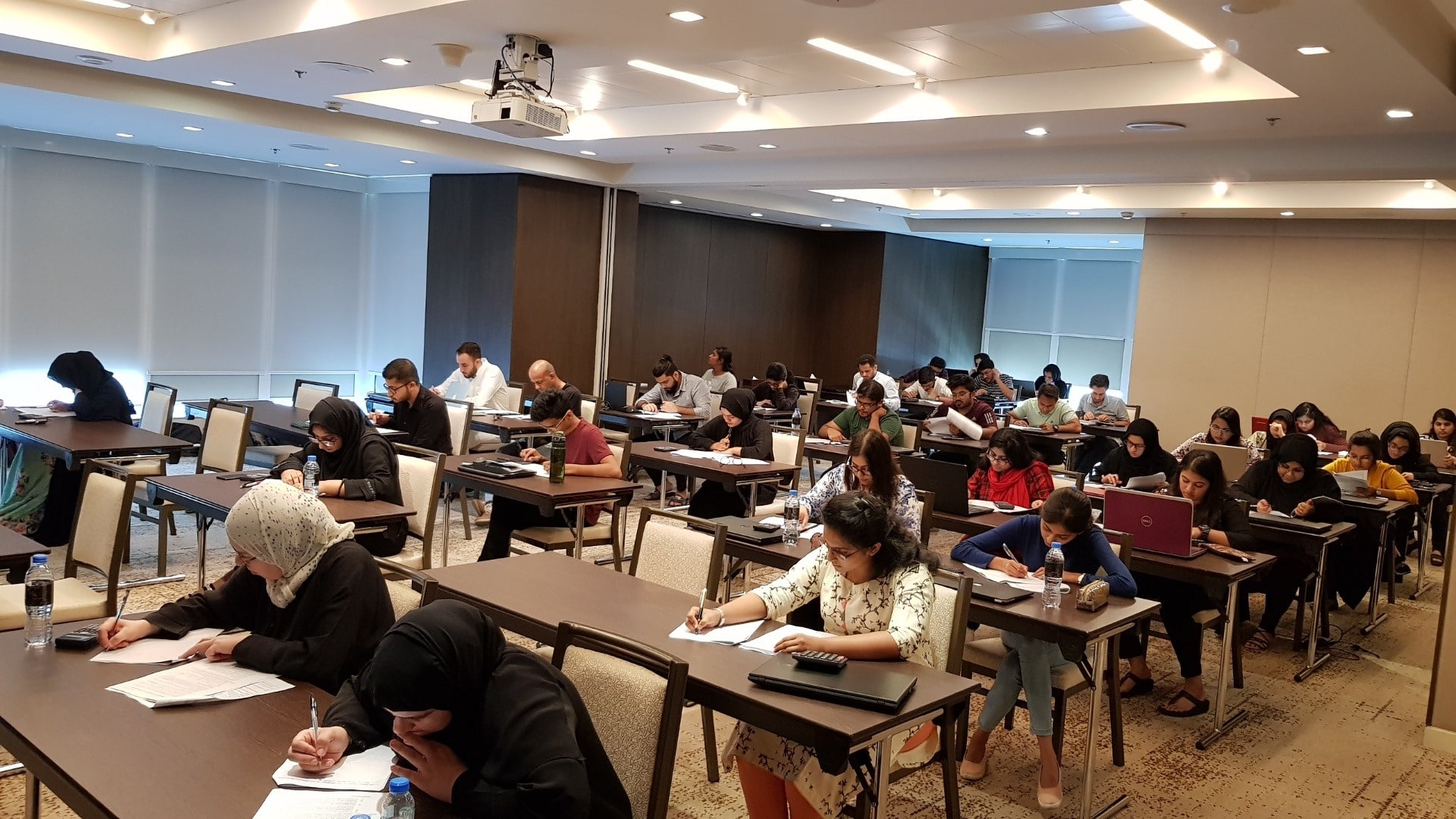

Financial Modeling in Practical World

This training program equips individuals to work with historical information on companies and analyze the company / industry performance. This analysis is then used as an input to build financial models. These models then provide with future financial performance of the companies analyzed and hence give an estimate of their valuation.

Training Objective

Analysis to build financial models for businesses and evaluation on projection of financial performance of an organization. The training program focuses on models which equip individuals for projection of financial evaluations, especially in context to the future financial performance of the companies. This is accompanied with the capacity to form structured analysis and provide estimates regarding the valuation of companies

Who should attend

- Entry level finance professionals

- Investment professionals

- Financial analysts

- Corporate bankers

- And lateral hires

Training Content

HANDS-ON TRAINING TO BUILD REAL-WORLD MODELS WITH EXAMPLES FROM TODAY’S TOP FIRMS

- Use common function keys

- Construct a basic IF statement

- Differentiate between different ways of summing and counting

- Select alternatives to using the IF function

- Use error trapping

- Control the appearance of numbers and text

- Apply various methods for determining dates

- Select and apply appropriate lookup and reference functions

- Create a Pivot Table to analyze data sets

- Use functions for discounting on uneven periods

- Understand other useful Excel features

- Apply financial modeling best practices

- Project an income statement and balance sheet

- Force-balance the balance sheet

- Construct a Statement of Cash Flows

- Calculate free cash flow

- Incorporate projection scenarios in a model

- Add an automatic cash sweep feature to a model

- Construct a discounted cash flow model to determine the intrinsic value of equity

- Perform meaningful sensitivity analysis

- Construct a valuation sheet to apply the APV valuation approach

- Value a stream of future interest tax shields

- Measure residual earnings (earnings above or below required earnings).

- Determine the value of earnings using accrual accounting

- Determine the value of equity or the firm using multiples

Get In Touch