In today’s dynamic business environment, a strong foundation in accounting and finance is no longer just a competitive advantage; it’s a fundamental necessity for success. This is particularly true in the UAE, where a thriving economy and a focus on innovation demand a skilled workforce equipped to navigate complex financial landscapes. This article explores the critical role of accounting and finance expertise in driving business growth within the UAE, examining the evolving skillsets required by professionals in this field. We will delve into the impact of technology and the importance of a multi-dimensional approach, highlighting how continuous learning and training programs empower accounting and finance professionals to become strategic partners in business success.

The Cornerstone of Growth: Accounting and Finance Expertise

Accounting and finance professionals are not just number crunchers; they are strategic partners who contribute significantly to business success. Here’s how they drive growth:

Strategic Financial Planning:

- Developing and implementing comprehensive financial plans aligned with business objectives.

- Forecasting future financial performance and identifying potential risks and opportunities.

- Conducting feasibility studies and evaluating investment proposals.

Financial Analysis and Reporting:

- Providing accurate and insightful financial reports to stakeholders (investors, creditors, management).

- Analyzing financial data to identify trends, assess performance, and identify areas for improvement.

- Developing key performance indicators (KPIs) to track progress towards business goals.

Cost Management and Optimization:

- Identifying cost-saving opportunities through process improvement and efficiency enhancements.

- Developing and implementing cost control measures to maximize profitability.

- Managing cash flow effectively to ensure liquidity and financial stability.

Risk Management and Mitigation:

- Identifying and assessing financial, operational, and reputational risks.

- Implementing strategies to mitigate risks and ensure business continuity.

The Evolving Landscape: New Skills for a New Era

The accounting and finance profession is undergoing a rapid transformation, driven by technological advancements, globalization, and increasing regulatory complexity. Key skills for success in the modern era include:

Data Analytics and Business Intelligence:

- Analyzing large datasets to identify trends, uncover insights, and make data-driven decisions.

- Utilizing tools like business intelligence platforms and data visualization software.

Technology Proficiency:

- Mastering cloud computing platforms, automation tools, and financial technology (FinTech) solutions.

- Adapting to emerging technologies like artificial intelligence (AI), machine learning, and blockchain.

Communication and Collaboration:

- Effectively communicating complex financial information to both technical and non-technical stakeholders.

- Collaborating effectively with other departments to achieve business objectives.

Strategic Thinking and Business Acumen:

- Understanding the broader business context and its impact on financial performance.

- Contributing to strategic planning and decision-making at the executive level.

Ethical Conduct and Professionalism:

- Maintaining the highest ethical standards and adhering to professional codes of conduct.

The Impact of Technology: Transforming the Role of Finance Professionals

Technology is revolutionizing the accounting and finance function in several ways:

- Automation: Automating routine tasks like data entry, reconciliations, and report generation, freeing up professionals for more strategic activities.

- Enhanced Data Analysis: Leveraging AI and machine learning to identify patterns, predict future trends, and improve decision-making.

- Cloud Computing: Enabling real-time access to financial data, facilitating collaboration, and improving operational efficiency.

- Blockchain Technology: Revolutionizing financial transactions, improving transparency, and enhancing security.

The Importance of Continuous Learning and Training

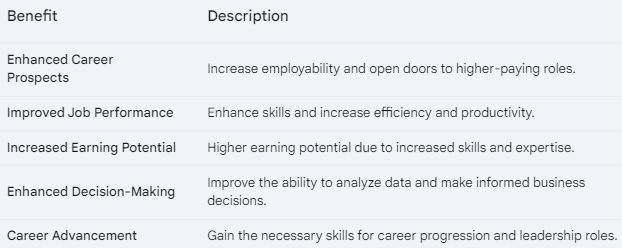

In this rapidly evolving landscape, continuous learning is crucial for accounting and finance professionals to stay ahead of the curve. Training programs can help by:

- Developing in-demand skills: Equipping professionals with the latest knowledge and skills in areas like data analytics, cloud computing, and cybersecurity.

- Staying abreast of regulatory changes: Ensuring compliance with the latest accounting standards, tax regulations, and industry best practices.

- Developing strategic thinking and leadership skills: Preparing professionals for leadership roles and senior management positions.

- Enhancing professional credibility: Demonstrating a commitment to professional development and staying ahead of the curve.

Synergic Training: Your Partner in Financial Excellence

Synergic Training offers a comprehensive range of accounting and finance training programs designed to equip professionals with the skills and knowledge they need to thrive in the UAE’s dynamic business environment. Our programs cover a wide range of topics, including:

- Financial Accounting and Reporting

- Management Accounting

- Cost Accounting

- Financial Analysis and Interpretation

- Financial Modeling and Forecasting

- Taxation

- Risk Management

- Internal Audit

- Data Analytics and Business Intelligence

- Leadership and Management

Accounting and finance professionals play a pivotal role in driving business growth and success in the UAE. By embracing continuous learning, developing in-demand skills, and adapting to the evolving business landscape, they can ensure their continued relevance and contribute significantly to the economic prosperity of the nation. Synergic Training is committed to empowering professionals with the knowledge and skills they need to excel in this dynamic environment.