VAT CONSULTING

We are helping you to be effective for all aspects related to Value Added Tax (VAT) in UAE

VAT based factors are an integral part for on-going businesses in the UAE, based on the regulations by the UAE Ministry of Finance. While offering limited exceptions to some categories including basic food items, healthcare and education, Value Added Tax (VAT) will be collected at the rate of 5 % on the goods and services, at each step of the supply chain. Synergic’s tax specialists help businesses structure in-house consolidation, recording and filing processes to ensure that your company does not incur any penalties from improper compliance. We will help you identify the potential financial challenges you might face in the implementation of VAT. We can also assign you a dedicated VAT consultant to update you on the latest developments regarding the legislation.

So you want to be a VAT?

Evaluate & Plan

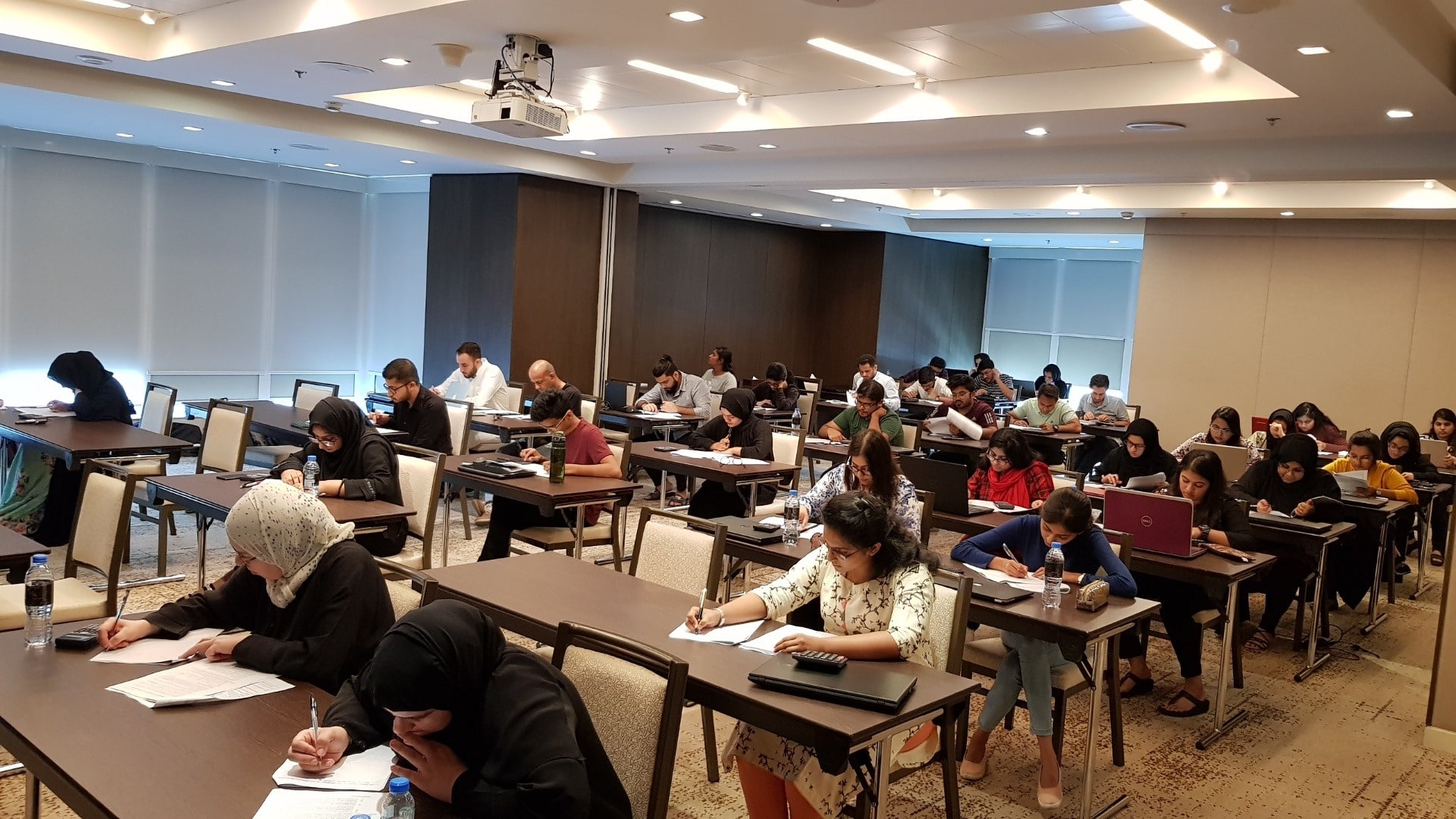

This phase entails to business impact assessment, review of key documents like existing contracts and incorporation of VAT clauses in the existing and new contracts and related documents. Training sessions to create an organization-wide awareness and preparedness on the effect of VAT implementation.

Design Develop & Train

Synergic Training will advise, develop and assist in restructuring transactions, supply chain and other related processes. We will also advise and support for requisite changes in the IT systems and applications.

Implementation

VAT implementation will have significant compliance costs to the Companies to carry out. There could also be cash flow implications. Supply chains need to be reviewed to understand the impact of VAT. Synergic Training will assist in VAT registrations and in the preparation and filing of VAT returns. Align compliance practices with VAT requisites.

How to prepare for VAT?

VAT rules can be complex and the implications are not always considered. Implementation of VAT needs careful planning for its success. Our dedicated VAT team will help you consider every stage of the implementation process.

VAT Advisory & Implementation

We can provide a set-up of a simple accounting systems and implementation of VAT rules.

- Assist with the VAT registration

- Identification and analysis of the VAT impact on your business

- Analysis of IT system and accounting requirements

- Preparation and filing the VAT returns

- Assistance in claiming VAT refunds